RuPay

RuPay

- Introduction

- Benefits of RuPay Card

- Lower cost and affordability

- Customized product offering

- Protection of information related to Indian consumers

- Provide electronic product options to untapped/unexplored consumer segment

- Inter-operability between payment channels and products

- Offers on RuPay Debit Card

- Online Payments

- Key Features

- How to use your RuPay card online?

Introduction

RuPay is a brand of NPCI under which it operates the card scheme. The National Payments Corporation of India (NPCI) is a pioneer organization in the field of retail payments in India. It is a body promoted by RBI and has presently ten core promoter banks (State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC).

The vision of NPCI being able to provide citizens of our country anytime, anywhere payment services which are simple, easy to use, safe, and secure, fast and also cost effective. NPCI aims to operate for the benefit of all the member banks and the common man at large.

Benefits of RuPay Card

The Indian market offers huge potential for cards penetration despite the challenges. RuPay Cards will address the needs of Indian consumers, merchants and banks. The benefits of RuPay debit card are the flexibility of the product platform, high levels of acceptance and the strength of the RuPay brand-all of which will contribute to an increased product experience.

Lower cost and affordability

Since the transaction processing will happen domestically, it would lead to lower cost of clearing and settlement for each transaction. This will make the transaction cost affordable and will drive usage of cards in the industry.

Customized product offering

RuPay, being a domestic scheme is committed towards development of customized product and service offerings for Indian consumers.

Protection of information related to Indian consumers

Transaction and customer data related to RuPay card transactions will reside in India.

Provide electronic product options to untapped/unexplored consumer segment

There are under-penetrated/untapped consumers segments in rural areas that do not have access to banking and financial services. Right pricing of RuPay products would make the RuPay cards more economically feasible for banks to offer to their customers. In addition, relevant product variants would ensure that banks can target the hitherto untapped consumer segments.

Inter-operability between payment channels and products

RuPay card is uniquely positioned to offer complete inter-operability between various payments channels and products. NPCI currently offers varied solutions across platforms including ATMs, mobile technology, cheques etc and is extremely well placed in nurturing RuPay cards across these platforms.

Offers on RuPay Debit Card

- Concierge Services

- Fuel Surcharge waiver

- IRCTC cashback

- Utility bill payment cashback

- Domestic Lounge access

Online Payments

RuPay E-commerce solution from National Payments Corporation of India (NPCI) enables RuPay cardholders to transact online. It not only provides a platform for online transactions but also gives the customers a unique shopping experience. NPCI through its e-commerce solution, RuPay PaySecure, is already live with all major Acquiring banks and aggregators in the online space in the country.

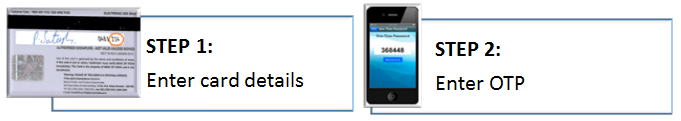

RuPay e-commerce transaction experience is seamless since the user has to enter just the card details and a One Time Password (OTP) to complete the transaction.

Key Features

- No separate registration required.

- User Friendly

- Simplified transaction flow

- Effortless authentication process

- Enhanced User Interface: Single-screen checkout

- Faster transaction processing:The cardholder has to enter just the card details and a One Time Password (OTP) to complete the transaction.

- Highly secure:Abides by 2FA mandated by RBI for Card Not Present transactions. Card details and OTP are used as the factors of authentication.

How to use your RuPay card online?

Last Modified : 7/3/2023

This topic deals with information related to Anxie...

This topic provides information about Sim Card Swa...

The Article provides information about Antioxidant...

This topic provides information about Causes, targ...